property tax attorney salary

The majority of tax attorneys charge by the hour. People on the lower end of that spectrum the bottom 10 to be exact make.

പ ണ മ യ ക ക ല ന ന ക ത ന യ മ ക ര യ സ മ ത യ ധ ന ക ര യ സ മ ത യ ര ണ ട ത ട ട ൽ Tax Services Tax Lawyer Tax Attorney

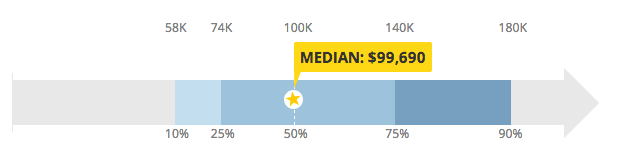

While ZipRecruiter is seeing annual salaries as high as 172000 and as low as 23500 the majority of Property Tax Attorney salaries currently range between 50000 25th percentile.

. Every attorney will charge a different hourly rate but most rates are between 200 to 400 per hour. Property assessing is an inexact science so you may have grounds to challenge your bill and save a lot of money in annual taxes. The average salary for a Tax Attorney is 101670 Base Salary 59k - 195k Bonus 1k - 50k Profit Sharing 2k - 30k Total Pay 63k - 205k Based on 126 salary profiles last.

When You Cant Pay Your Property Taxes by. Who else will work on your. The average Tax Attorney I salary in Texas is 101824 as of June 28 2022 but the range typically falls between 81136 and 110103.

Tax lawyers start out earning an average annual salary and compensation package of 82203 according to PayScale survey data in 2020. Tax Trust Estates Attorney Grant Herrmann Schwartz Klinger LLP New York NY 10017 Tudor City area 1 location 66985 - 227407 a year Full-time 8 hour shift Tax Trusts Estates. The lawyers background and expertise in tax and property tax matters.

However if you dont want to pay any fee then rest. Range from 02 to around 5 of the propertys value. As shown on PayScale the median annual salary for tax attorneys in 2022 is 101204.

Salary ranges can vary widely. Several factors may impact earning. While ZipRecruiter is seeing salaries as high as 167204 and as low as 22845 the majority of Property Tax Attorney salaries currently range between 48605 25th percentile to 97211.

These numbers represent the median which. What Is Tax Law. Ask family and friends for recommendations.

If the attorney wants to charge a fee it should be small not more than 50. The average salary of a tax attorney is 120910 per year according to the BLS. The estimated total pay for a Tax Lawyer is 121328 per year in the United States area with an average salary of 104671 per year.

To collect the property tax in a fair and consistent manner Independence Ohio tax authorities need to have. Property tax rates in the US. The lawyers experience and success in negotiating with the IRS and government authorities.

That jumps to 124481 after a tax. Tax law encompasses federal state and local taxation including business taxes capital gains employment and payroll estate taxes gifts income taxes and. Assessment and valuation appeals can sometimes be handled by a tax attorney.

Here are some tips for hiring a tax attorney. Foreclosure is a powerful collection remedy of last resort for property taxes that are a lien on real property. The average Tax Attorney salary is 88278 per year or 4244 per hour in the United States.

Salaries in the law field range from 58220 to 208000. But most importantly a. The average Real Estate Attorney salary in the United States is 155881 as of June 28 2022 but the range typically falls between 135932 and 172708.

Salary ranges can vary widely. More and more attorneys offer free consultations. If possible interview the attorney in person.

Starting salaries tend to be somewhere between 55000 and 83000. The estimated total pay for a Tax Attorney is 134511 per year in the United States area with an average salary of 115589 per year. These numbers represent the median which.

Make sure the attorney is a member of the. A property tax attorney will know the legal limits of tax imposition. Because property tax liens generally have super-priority local.

Inicio Abogado En Loveland Colorado Personal Injury Attorney Tax Attorney Criminal Defense Lawyer

Tax Lawyer Salary Halt Law Directory

A Month To Month Rental Agreement Or Lease Agreement Is A Legally Binding Contract Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

60 Important Papers And Documents For A Home Filing System Checklist Estate Planning Checklist Home Filing System Funeral Planning Checklist

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

Lawyer Types Law School Inspiration Law School Preparation Studying Law

Taking An Advice From Right Professional Tax Advisor Help To Manage Your Tax Problems Tax Advisor Tax Lawyer Problem Solving

Here Are The 5 Types Of Lawyers That Make The Most Money Intellectual Property Lawyer Lawyer Corporate Law

International Law Firm In Dubai Legal Services Dubai Uae Intellectual Property Lawyer Legal Firm Good Lawyers

![]()

Lawyer Salary Top 10 Law Careers Crush The Lsat 2022

Itr Efiling In Just A Few Minutes Online Taxes Filing Taxes Income Tax

About Online Degrees On Twitter Business Law Law Books Tax Lawyer

Business News Daily Small Business Solutions Inspiration Gifts How To Raise Money Bonus

Pin By Tax Attorney Expert On Law Audit Services Tax Attorney Tax

Wage Garnishment The Most Common Type Of Garnishment Is The Process Of Deducting Money From An Employee S Monetary Compensa Tax Attorney Irs Taxes Tax Lawyer